The Rise of Alternative Cannabinoids

Growing Consumer Demand for Novel Cannabinoids and Product Innovation

Executive Summary

As the cannabis market evolves, consumer demand is shifting beyond high-THC and standard CBD products toward alternative cannabinoids such as Delta-8-THC, CBN, CBG, HHC, THCv, THCp and others. Market data highlights a growing interest in these compounds, driven by the desire for more personalized and functional product experiences.

This white paper presents the evidence behind rising consumer demand for alternative cannabinoids, explores which product formats are gaining the most traction, and highlights the consumption trends signaling sustained market growth in this category.

1. Consumer Demand is Rising

Over the past decade, cannabis has transitioned from a fringe substance to a mainstream topic of discussion in the United States. This shift is evident in the growing awareness and interest among adults regarding various cannabinoids beyond the well-known THC and CBD.

Together, these figures illustrate the growing interest is not just curiosity, it’s conversion. Many consumers who try cannabinoids like Delta-8, CBG, or CBN continue to purchase them based on specific effects. In fact, retention rates among alternative cannabinoid users are consistently high; once consumers experience a functional benefit such as relaxation, focus, or improved sleep, they’re more likely to return to that specific product or blend. The growing focus on effect-based consumption reflects a clear consumer preference for products that deliver specific functional outcomes, rather than just flavor or potency. This trend underscores increasing demand for minor cannabinoids to be recognized as purposeful ingredients, valued for their targeted effects rather than novelty appeal.

Opportunity for Brands: These compounds offer a way to target a more experimental segment of the market with tailored messaging and effects-based product lines.

2. Functional Benefits Are Driving Purchase Decisions

Alternative cannabinoids are gaining popularity because of their specific functional associations:

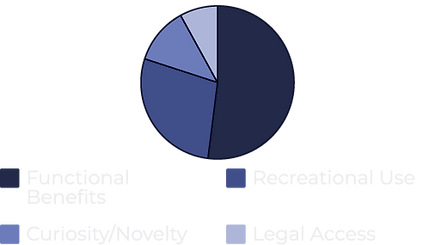

Source Arvida Labs ⁴

58% of consumers purchase hemp‑derived cannabinoids specifically for their functional benefits, such as stress relief, relaxation, sleep support, or mood enhancement.⁵

What's enabling this shift isn't just marketing, it's the emerging science around the entourage effect. While anecdotal reports of synergistic cannabinoid and terpene interactions have long circulated in cannabis culture, research is now beginning to validate these claims. Recent studies suggest that combining cannabinoids like CBG or CBN with specific ratios of THC or CBD can alter not just potency, but the quality of the psychoactive and physiological effects.⁶

Standard Seed AI is collecting Consumer patient journal data on commercial products to provide "Aggregated data from consumer journals, patient reports, and clinical observations to understand real-world efficacy and safety profiles of botanical products."

On the other hand, they are also using AI to make advances with chemical to disease pathway and physiological effects of compounds with, "Comprehensive database linking botanical compounds to specific disease mechanisms, physiological responses, and therapeutic outcomes through AI-driven pathway analysis." ⁷

As researchers unravel how different cannabinoids interact with the endocannabinoid system and other biological systems, we have a greater scientific foundation to build effect-specific formulations, not just strain names or generic sativa/indica binaries. This opens the door for consistent, repeatable experiences based on real pharmacological interactions rather than legacy branding.

Strategic Insight: Brands can go beyond traditional potency claims and position products by occasion, "Calm," "Social," or "Focus" - using blends of cannabinoids that are still novel to many consumers.

3. Regulatory Flexibility - For Now

While state-level regulations continue to evolve, hemp-derived cannabinoids like Delta-8 are technically legal in many states where recreational cannabis is not.

The road ahead for hemp legislation is full of possibilities. States are expected to refine their policies as they learn from the experiences of early adopters. Emerging issues, such as the regulation of minor cannabinoids like delta-8 THC, will likely shape future legislative debates.

Staying informed and engaged is essential for anyone involved in the hemp industry. By advocating for fair and sensible regulations, stakeholders can help ensure that hemp continues to thrive in the United States.⁸

Cautionary Note: This regulatory ambiguity creates short-term opportunity, but long-term stability will depend on compliance and formulation discipline.

4. Retail & DTC Potential

Gummies lead the market in consumer preference, followed by disposable vapes and flower, while tinctures, topicals, and sublinguals remain the least favored cannabis product formats.

Source: Brightfield Group, Hemp-Derived THC Consumer Trends & Purchase Drivers⁵

Strategic Takeaway: Alternative cannabinoids allow brands to bypass traditional licensing bottlenecks and test DTC models across state lines.

5. Brand Differentiation in a Crowded Market

Most cannabis products on dispensary shelves still compete based on THC potency. This race to the top of the THC curve is limiting innovation and consumer loyalty.

Brand Insight: Some of the fastest-growing brands in 2024 are those offering multi-cannabinoid formulations aimed at specific moods or functional states.

6. Market Outlook

The U.S. cannabinoids market is projected to hit $60 billion by 2030, growing at a CAGR of over 15% from 2023 onward. This momentum is being driven by rising consumer interest in isolated cannabinoids and ongoing clinical research expanding our understanding of their potential. At the same time, an influx of new brands is increasing product availability and pushing the market forward at speed.

The Data Is Clear: Consumers Are Driving This Category Forward

The next evolution of cannabis is no longer about chasing potency or selling generic cannabinoid percentages, it’s being driven by unmistakable consumer demand for targeted, effect-based products. Across the country, people are actively seeking out cannabis products that deliver specific functional benefits, whether it’s help with sleep, relaxation, focus, mood elevation, or physical relief. This shift is especially apparent in the rising popularity of alternative cannabinoids like Delta-8 THC, CBN, CBG, HHC, and others, which offer differentiated effects far beyond the traditional THC-dominant model.

This isn’t just a passing trend, it’s a meaningful shift in how consumers are integrating cannabis into their daily lives. Many of these alternative cannabinoid products are already being used as substitutes for over-the-counter and even prescription medications. Consumers are turning to cannabinoids like CBN for sleep, CBG for mood regulation, THCv for focus and Delta-8-THC for a gentler, more manageable euphoric experience. In real time, we’re seeing cannabis products evolve from recreational novelties into functional wellness solutions that fit into health routines.

This rise in demand also signals something bigger: the potential for alternative cannabinoids to accelerate the mainstream acceptance of cannabis within the broader health and medical industries. As more consumers experience tangible, targeted benefits, the conversation is shifting away from outdated stigma toward real acknowledgment of cannabis as a wellness and therapeutic tool. Alternative cannabinoids are leading this shift, not just because they offer legal flexibility, but because they meet consumer needs in ways that conventional products do not.

At Arvida Labs, we partner with brands to meet this undeniable demand. We help develop and scale products built around functional effects and alternative cannabinoids; products that reflect the real-world ways people are using cannabis today. From smart formulation to large-scale production, we’re enabling brands to serve a rapidly growing consumer base that’s redefining cannabis through the lens of wellness, functionality, and future medical relevance.

References

-

Boehnke, K. F., et al. (2023). Past-Year Use Prevalence of Cannabidiol, Cannabigerol, Cannabinol, and Delta-8-Tetrahydrocannabinol in the United States. JAMA Network Open, 6(1), e2252090. https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2812825

-

New Frontier Data. (2023). Cannabis Consumers in America 2023: Part 1.

https://www.dispensaries.com/blog/half-of-americans-use-or-want-to-try-cannabis/

-

Herrington, A. J. (2023, August 14). Gallup Poll Shows Half Of Americans Have Tried Marijuana. https://www.forbes.com/sites/ajherrington/2023/08/14/gallup-poll-shows-half-of-americans-have-tried-marijuana/

-

Arvida Labs. Arvida Labs page; Cannabinoids: From CBD to THC-V, here's everything you need to know about the cannabinoids in our Arvida Labs Isolate and Distillates. https://www.arvidalabs.com/about-our-cannabinoids

-

Brightfield Group. 2024 Hemp-Derived THC Consumer Trends & Purchase Drivers. https://content.brightfieldgroup.com/hemp-thc-consumer-trends-report

-

Ethan B Russo. (2019). The Case for the Entourage Effect and Conventional Breeding of Clinical Cannabis: No "Strain," No Gain. Frontiers in Plant Science. https://www.frontiersin.org/articles/10.3389/fpls.2018.01969/full

-

Standard Seed AI. Home Page content. https://standardseedai.com/

-

American Healthy Alternatives Association. (2025). Hemp Legislation Updates Across the U.S.: What You Need to Know.

https://myhealthyusa.org/blogs/news/hemp-legislation-updates-2025

-

Research and Markets. Cannabinoids Market Report 2025. https://www.researchandmarkets.com/report/cannabinoids#tag-pos-1